Investment Strategy

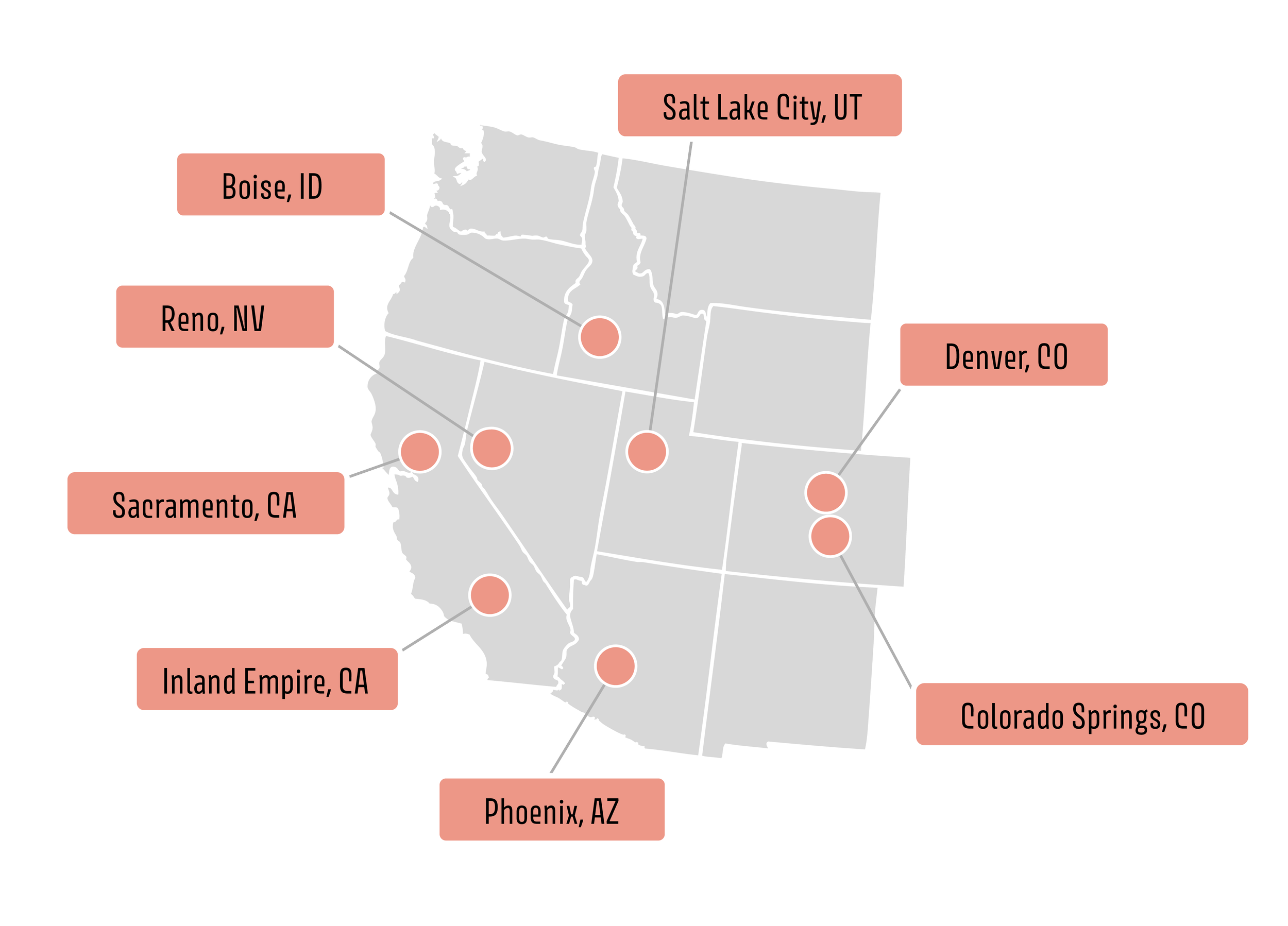

Rosepeak uses a research first approach to identify target markets and specific assets for acquisition. Only those opportunities that meet our specific market, location, physical plant and other investment criteria are considered.

-

+Targets under-managed assets and/or assets with upside from physical improvements

+Properties - 1990s and newer

+$5k-$50k per unit in capital improvements

+Return on upgrade capital of 20%+

-

+Targets new construction assets that are coming off of original construction financing and face debt refinancing/equity re-margining challenges

+Properties – 2020 and newer

+Properties can be acquired at attractive current basis often 50%-80% of replacement cost providing for long-term upside as market conditions recover

+Will utilize creative debt/equity strategies to initially acquire properties that will often not be fully stabilized

-

+Targets properties with strong in-place net operating income that can be financed with positive leverage to produce attractive cash-on-cash returns with limited execution risk

+Properties – Newer assets (2000+) in clean physical condition with limited capital needs

+Ideal for high net worth (HNW) or 1031 investors focused on capital preservation, current income and tax efficiency